By Rom Badilla

The U.S. Conference Board released its monthly sentiment index, which rebounded after plummeting in the previous two months. The Consumer Confidence Sentiment Index, which is based on a representative sample of 5000 households, increased to by two and half points to 53.5 in August, surpassing market forecasts as economists were expecting an index reading of 50.7. The August increase reverses the freefall of the last two months as Consumer Confidence reached a 2010 high of 62.7 in May. While encouraging, confidence among consumers remains low relative to the period prior to the onset of the recession as the index averaged 103.4 in 2007.

As reported on the Conference Board website, Director, Lynn Franco stated that, “Consumer confidence posted a modest gain in August, the result of an improvement in consumers’ short-term outlook. Consumers’ assessment of current conditions, however, was less favorable as employment concerns continue to weigh heavily on consumers’ attitudes. Expectations about future business and labor market conditions have brightened somewhat, but overall, consumers remain apprehensive about the future. All in all, consumers are about as confident today as they were a year ago.”

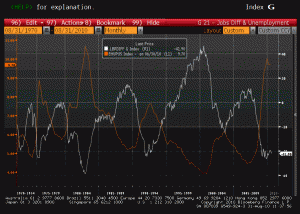

Looking beyond the headlines, the Expectations component of the survey, which represents people’s outlook, increased 7.4 percent to an index value of 72.5 in August. However, the Present Situation component fell 5.7 percent to 24.9. Furthermore, employment prospects remain relatively low. The Labor Differential Index, which is by defined by subtracting the Jobs Hard to Get component from the Jobs Plentiful component and is correlated to the official unemployment rate, mires in negative territory suggesting difficult employment conditions. The Labor Differential Index fell from -40.7 in July to -41.9 in August. As a source of comparison, the index reached a low of -46.1 in November 2009 and peaked in March 2007 at 11.4. (Click to enlarge)

In addition to today’s consumer confidence release, Standard & Poor/Case-Shiller released its Home Price indices. The 20-city composite, which measures home values in the largest metropolitan markets in the U.S., increased slightly by 4.23 percent on a year over year basis in June. The increase came in above consensus surveys as economists expected an increase of just 3.5 percent. The better than expected number follows a May reading of 4.64 percent which was revised upward from initial readings by 0.3 percent. In addition, home prices on a national level increased. For the second quarter, the S&P/Case-Shiller U.S. Home Price Index increased by 3.6 percent from last year. Furthermore, the first quarter home prices were revised upward from an initial increase of 2.0 percent to a final 2.3 percent.

Disclosure: None

This is great counter-balance to the last two months of sentiment--which is often self-perpetuating.

No comments:

Post a Comment